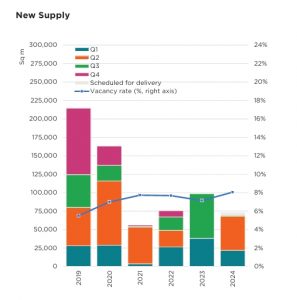

Just how low is the new supply going to be for the next few years? Isn’t it fair to say we’ve entered a new chapter of Prague’s office market?

The Prague office market is indeed entering a period of significantly reduced new supply, with only around 73,000 square meters of office space expected to be completed in 2024. In 2025, this will drop further to just 23,400 square meters, and in 2026, only 68,200 sqm are expected, primarily from developments that began in the previous year. This level of new supply is well-below the historical average, largely due to high construction costs and tighter financing options that have limited new project starts.

The current vacancy rate sits at approximately 8.1%, yet only a small portion of this space meets the high-quality (AAA) standards preferred by larger companies. This scarcity is expected to intensify competition for prime office space, likely leading to increased rental prices, especially in sought-after locations.

However, it’s not an entirely new situation for Prague’s office market; there have been similar periods in the past when new supply was temporarily low (due to various reasons). These times have generally led to constrained leasing conditions and higher competition among tenants.

However, it’s not an entirely new situation for Prague’s office market; there have been similar periods in the past when new supply was temporarily low (due to various reasons). These times have generally led to constrained leasing conditions and higher competition among tenants.

Moving forward, with fewer projects anticipated in the pipeline, this new phase will likely shape tenant strategies, impacting availability and leasing costs for high-quality spaces.

What do you see as the causes? Obviously, there’s the remote work trend, but that seems to be combining with stricter lending conditions, higher rents and higher moving costs.

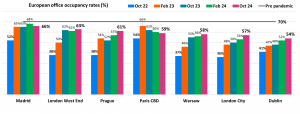

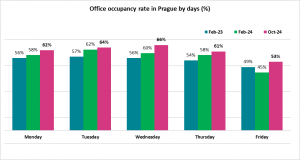

We don’t view remote work as a long-term trend significantly affecting office demand anymore. In fact, physical occupancy rates have now surpassed 60 percent for the first time since the pandemic, nearing pre-COVID levels. This indicates that businesses are increasingly returning to office spaces, and the demand for physical office locations remains strong. The challenge, however, lies in the availability of high-quality office options, which remains limited in the short term.

The situation is more influenced by traditional factors such as slow market processes, rising costs, and tightening lending conditions, which have compounded over time. These elements, combined with rents which are not growing fast enough (from the landlords perspective), could be seen as partially alleviating some of the challenges for landlords. While this presents a mixed picture, we anticipate that new office deliveries in late 2027 and particularly in 2028 will help balance the supply-demand dynamic in the market. Overall, the office market remains resilient, and we remain optimistic about its recovery and growth in the medium to long-term.

Have occupiers understood that if they don’t take new space now, it basically won’t be available?

Have occupiers understood that if they don’t take new space now, it basically won’t be available?

Some occupiers in Prague have come to the realization that delaying the decision to secure new office space could soon leave them with even fewer options. However, this situation is complex and depends on the specific needs of each company. Some occupiers are still waiting for potentially better conditions, but these may not arrive soon. Those who need space now are likely to face diminishing availability.

How much of a deterrent are costs associated to moving, and what have they been cause by?

The costs associated with moving offices in Prague remain an important deterrent for many companies, but the primary motivation for relocation is no longer solely to save costs, especially for those not drastically reducing their leased space. Moving costs include not only the physical relocation but also the expens of fitting out a new space, setting up new IT systems, and adapting the office layout. These costs can be considerable, particularly in premium office buildings, where fitout expenses tend to be higher.

Additionally, rising rents in desirable locations make leasing new space more expensive, and the limited availability of prime office spaces forces businesses to either pay higher rents or settle for less optimal locations. The disruption to operations, including potential downtime and productivity loss during the move, further discourages companies from relocating.

As a result, many businesses choose to negotiate lease extensions or adjust their current spaces, which allows them to avoid the significant financial and operational costs of moving.”

What’s the focus going to be for agency office teams going forward?

What’s the focus going to be for agency office teams going forward?

In the coming months, agency office teams in Prague will likely focus on lease renewals and renegotiations, as many companies are choosing to stay put rather than face the high costs and disruptions of relocating. With the limited availability of quality office space, agencies will assist clients in optimizing their existing spaces or securing extensions on their current leases. The growing influence of AI may also impact decision-making and efficiency in negotiations, but it’s important to note that no AI can replace the human touch during commercial negotiations, where understanding client needs and building trust remain essential.

There will also be a growing emphasis on flexible office solutions, as businesses continue to embrace hybrid work models. Agencies will need to guide clients in exploring coworking spaces and serviced offices to meet their evolving needs. Finally, with limited new supply, agencies will focus on managing available inventory, finding off-market opportunities, and helping clients navigate the competitive landscape to secure the best possible space.

Also in ThePrime

What role for developers in solving the affordability question?

Ernst Giese (Giese & Partner) to open AEEC’s Prague conference

Jan Mynář (Lexxus Norton): Value creation starts at the beginning