What do you get when you combine falling real estate valuations with higher interest rates and lower LTV in an inflationary environment? You get a commercial property market where big transactions are scarce, and brokers don’t know what price to list assets at.

“If you combine the cost of equity — which has to work harder — and the cost of debt, it’s simply very difficult to make a rationale at the moment that now is the right time to start putting money back into real estate,” Stuart Jordan (Savills) tells ThePrime Pod. “It’s a very complex situation but I don’t believe it’s particularly psychological, rather it’s actually quite simple maths based on economic sentiments.” The deals that are happening, he says, are driven by investors who know exactly what they’re looking for.

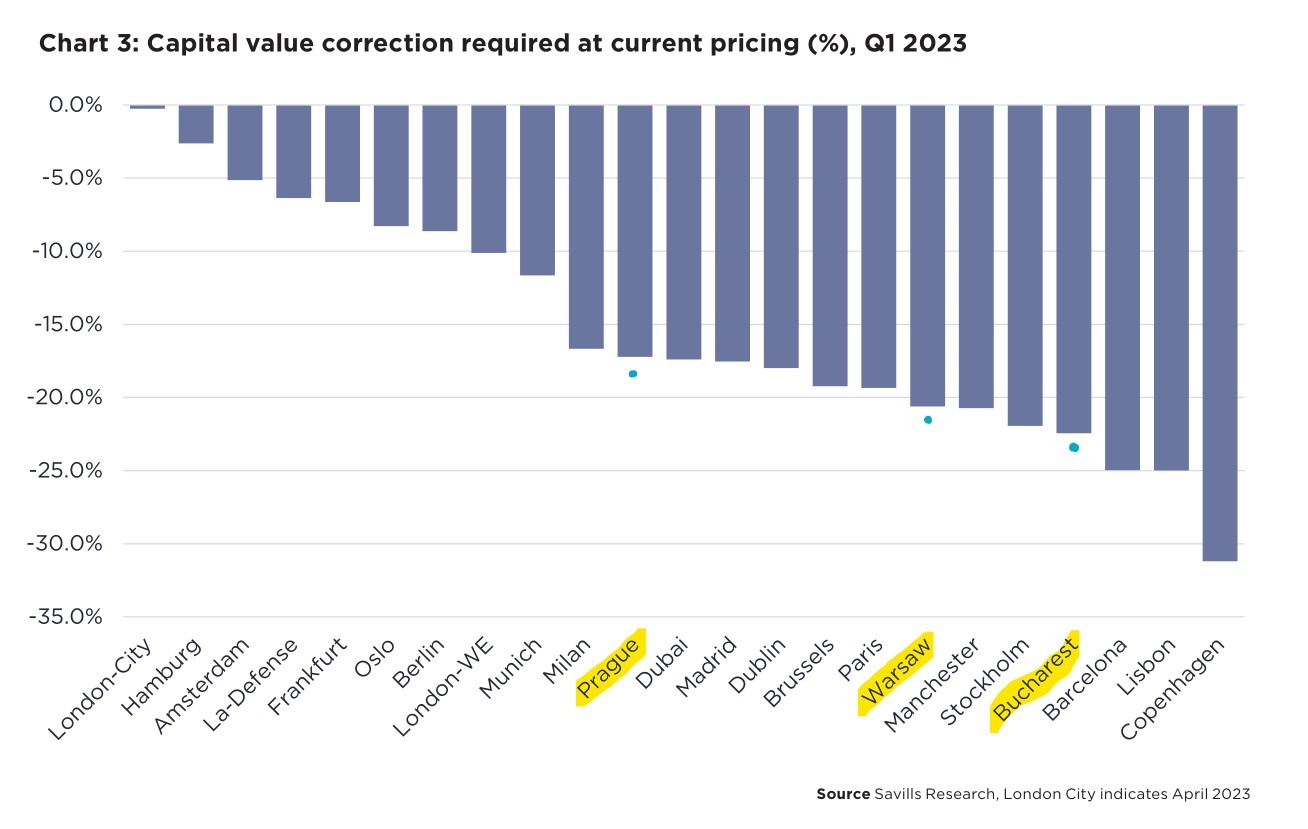

I set up the interview after reading a Savills report on the European office market which ranked cities based on to what degree prices for prime product have adjusted to the high interest rate reality. Prague still has up to 20% to go, according to the report.

(You can listen to this episode of ThePrime Pod the podcast on Spotify, Apple Podcasts or even on YouTube)