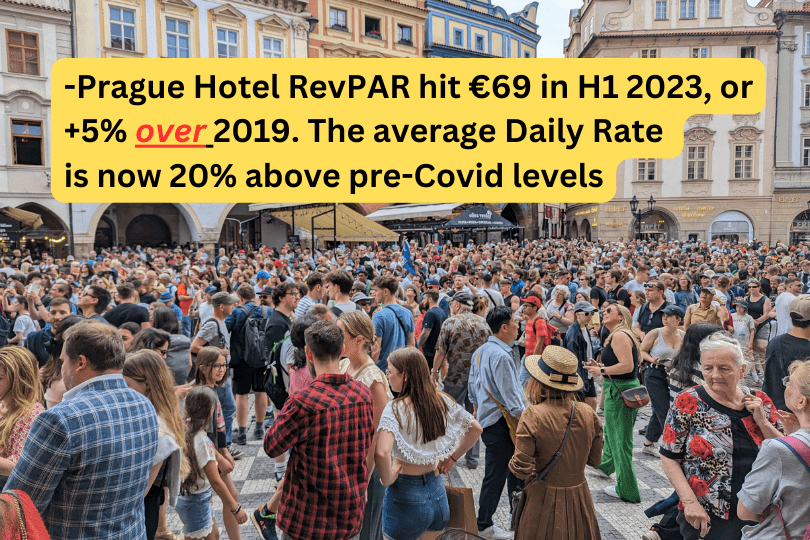

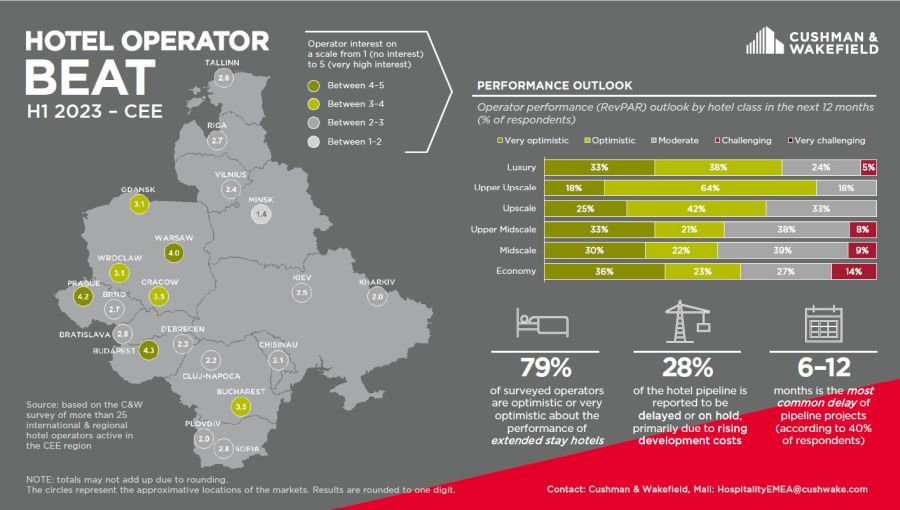

Budapest is Central Europe’s most attractive among operators currently active or interested in the region. But Prague comes in a close second, with RevPAR reaching €69 for the first half of 2023. That’s 5% above H1 2019, when hotel revenues in the city were peaking. The numbers come out even better for the average daily rate (ADR), which was 20% higher than 2019 levels. While hotel operators in the region express optimism about the industry’s outlook and claim to be keen to expand, 28% of planned hotel projects are either on hold or facing delays thanks to increased development costs.

Ranked on an ascending scale of 1-5, Prague achieved a 4.2 average, just behind Budapest’s result of 4.3. Warsaw, Krakow and Bucharest made up the remainder of CEE’s top 5 markets. Brno scored in the top 20 thanks to significant development by several international hotel chains.

Ranked on an ascending scale of 1-5, Prague achieved a 4.2 average, just behind Budapest’s result of 4.3. Warsaw, Krakow and Bucharest made up the remainder of CEE’s top 5 markets. Brno scored in the top 20 thanks to significant development by several international hotel chains.

“Driven by the restrained supply growth over the past few years, lower brand penetration and a modest luxury supply share compared to its CEE peers due to high barriers to entry, Prague is poised for a performance boost,” says David Nath, Head of Hospitality CEE & SEE (Cushman & Wakefield). “The imminent arrival of major luxury brands such as the W Prague Hotel and Fairmont Golden Prague Hotel, coupled with a gradual resurgence of airport passenger numbers to pre-Covid levels, invigorate prospects for elevated market performance.”

Also in ThePrime

Karolis Adlis (WP Carey): Leasebacks work in any environment

Ondřej Křivanec (Fidurock): Euro leases for residential work