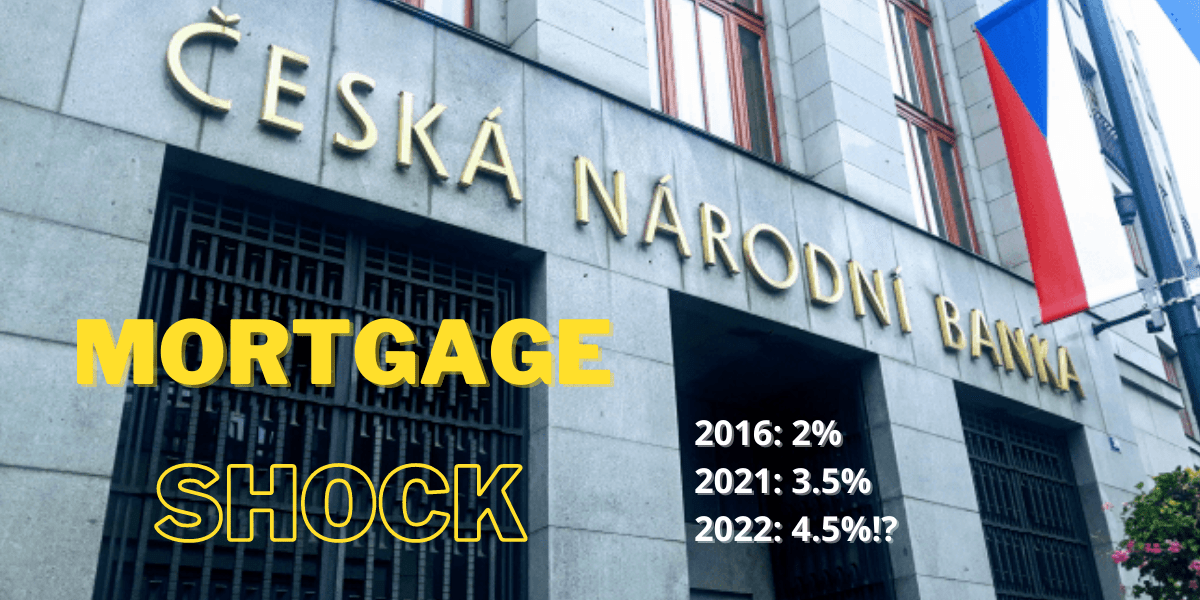

Economists, companies and consumers are still coming to grips with the Czech Central Bank’s shock interest rate hike from last week. Those with no time to spare are bank clients who took out mortgages with a 5-year fixation in 2017, or anyone else whose rates change next year. David Eim (Gepard Finance) told SeznamZpravy that rates in 2016 and 2017 averaged around 2.1%, meaning that many people will have signed on to mortgages at below 2%. Already, they’ll be unable to find offers below 3.59%, while some will struggle to do better than . . .

------------------------------------------------------------------------------

Subscriber content

Archival content is available to subscribers only. If you have a membership subscription and are are experiencing issues logging in, please try the login below:

If you're interested in reading further, why not gain full access to the archives by subscribing?

Order your subscription here and we'll send you an invoice.

Annual memberships (€100/yr) can also be paid for by credit card, or you can pay month-to-month by clicking here.