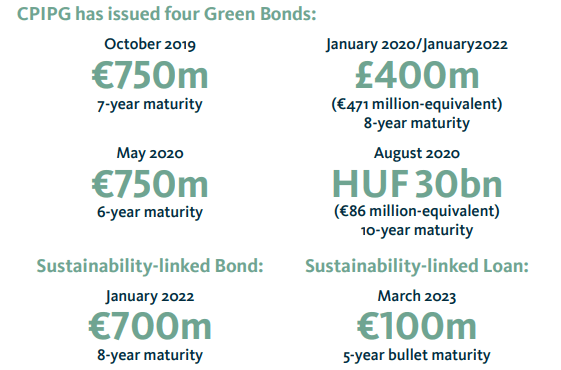

CPI announced that it’s closed on €500 million in 5-year unsecured green bonds, for which €3 billion in orders were placed by prospective investors. The coupon was set at 7%, which is significantly higher than its overall interest rate of 3.12% (as of Dec. 31, 2023). In a statement on the new bonds, CPI admitted the high cost of the bond but said the point was to improve the group’s liquidity and to show its ability to tap the market for funding.

“Events of past few years have created many opportunities for investors to test, examine and get to know CPIPG,” said David Greenbaum, CEO. “We are grateful for the support and remain focused on delivering for all stakeholders.” The new issuance is likely intended as a show of strength, following an attempt last December by short sellers to destabilize CPI’s capital structure. Barclays, Goldman Sachs, Santander, Société Générale, Erste Group, SMBC, Raiffeisen Bank International and UniCredit acted as joint bookrunners on the transaction.

“Events of past few years have created many opportunities for investors to test, examine and get to know CPIPG,” said David Greenbaum, CEO. “We are grateful for the support and remain focused on delivering for all stakeholders.” The new issuance is likely intended as a show of strength, following an attempt last December by short sellers to destabilize CPI’s capital structure. Barclays, Goldman Sachs, Santander, Société Générale, Erste Group, SMBC, Raiffeisen Bank International and UniCredit acted as joint bookrunners on the transaction.

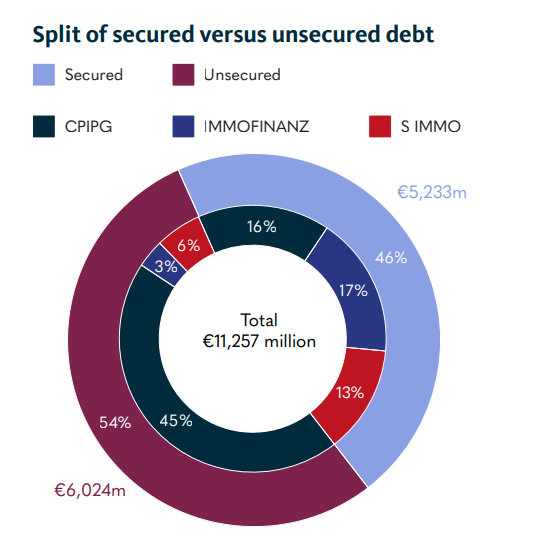

CPIPG will allocate an amount equivalent to the net proceeds to fully retire the bridge loans related to the acquisitions of Immofinanz and S Immo. The green bonds are listed on Euronext Dublin and are rated Baa3 by Moody’s and BBB- by Standard & Poor’s.