According to its most recently published results, CPI Property Group’s total assets stood at €23.5 billion as of the end of 2022, with a property portfolio of €20.9 billion with contracted rent of €906 million. A full 48% of the portfolio is made up of office properties, with retail responsible for another 23%. Speaking on a public webcast, CFO David Greenbaum said that the company’s primary focus in 2022 was completing and consolidating and the acquisition of Immofinanz and S Immo.

CPI had followed the two companies for years and studied “every asset from the ground up,” he said. “These acquisitions were an important way for CPI PG to buy portfolios that we could never replicate through individual purchases. We bought longstanding high quality assets and we paid below market price, which more or less defines our strategy as a long-term investor and landlord.”

The deals were “transformational” in the words of Greenbaum, because they put the goal of €1 billion in property related income “within our grasp.” CPI achieved 7.6% like-for-like growth in 2022, a figure Greenbaum predicts can be improved upon. “At this moment, we are not able to isolate for you exactly how much of the growth is due to inflation versus the market. But we suspect the greatest impact of inflation on the rent is still yet to come.”

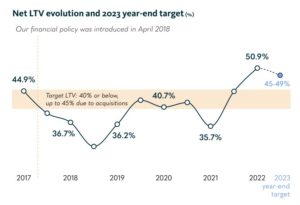

If there’s a negative side to CPI’s dramatic acquisition of Immofinanz and S Immo, it’s the impact on the company’s net LTV, which rose rapidly to 50.9%. It’s an unacceptable figure for the company, which hadn’t been in the original plan, when the acquisitions were launched in 2021. “The plan was changed by the war, by higher rates by broken bond markets and by raging inflation,” as Greenbaum says. “To date, we’ve spent about €3.4 billion to acquire shares of Immofinanz and S Immo. Of the of 3.4 billion, €2.7 billion was funded by drawing on our bridge financing.” So far, over 900 million of bridge loans have been repaid through disposals and “capital market activity”, leaving roughly €1.6 billion of the bridge loan outstanding.”

If there’s a negative side to CPI’s dramatic acquisition of Immofinanz and S Immo, it’s the impact on the company’s net LTV, which rose rapidly to 50.9%. It’s an unacceptable figure for the company, which hadn’t been in the original plan, when the acquisitions were launched in 2021. “The plan was changed by the war, by higher rates by broken bond markets and by raging inflation,” as Greenbaum says. “To date, we’ve spent about €3.4 billion to acquire shares of Immofinanz and S Immo. Of the of 3.4 billion, €2.7 billion was funded by drawing on our bridge financing.” So far, over 900 million of bridge loans have been repaid through disposals and “capital market activity”, leaving roughly €1.6 billion of the bridge loan outstanding.”

In August, CPI managed to extend the maturity of this financing out until 2025. “This gives us plenty of time to execute our disposals and deleveraging plans,” says Greenbaum. He says the primary goal for CPI in 2023 is to reduce net LTV to between 45% and 49%.

As Tomáš Salajka (Director of Acquisitions, Asset Management & Sales) readily admitted, rapidly changing market conditions have made the disposal process more challenging. “On the other hand, modest size deals of up to €100 million continue to see good demand from investors and banks. Real estate is still viewed as a defensive asset which will perform well in an inflationary environment. Income generating properties particularly with rents linked to inflation remain excellent for long term real assets.” CPI currently has around 30 properties under active discussion for disposal, spread across several countries and sectors.

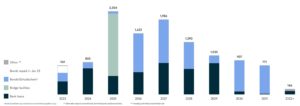

Greenbaum said the reality was CPI would most likely sign new secured loans this year. “In general, however, we want to focus on senior unsecured,” he said, offering insight into the company’s strategy. “We prefer the simplicity, the efficiency, the transparency for our bond investors. A high level of unencumbered assets also supports our credit ratings. On the other hand, the group must prioritize liquidity and be sensible about pricing. Bottom line, we might return to the unsecured bond market when the time is right, but definitely not any time soon and not at this pricing. We prefer the bank market right now.”

Greenbaum said the reality was CPI would most likely sign new secured loans this year. “In general, however, we want to focus on senior unsecured,” he said, offering insight into the company’s strategy. “We prefer the simplicity, the efficiency, the transparency for our bond investors. A high level of unencumbered assets also supports our credit ratings. On the other hand, the group must prioritize liquidity and be sensible about pricing. Bottom line, we might return to the unsecured bond market when the time is right, but definitely not any time soon and not at this pricing. We prefer the bank market right now.”

Also in ThePrime

€20 million Pilsner Urquell Experience opens Saturday in Prague