Isn’t persistently low unemployment going to make it tougher to curb inflation?

You’re not wrong about that, which is a problem for those who think that interest rates will fall soon. The CEE economies are geographically very well positioned, serving other economies with much higher labor costs. That’s a situation that’s going to exist for probably another 20 years of so-called ‘convergence time.’ But it means we’re going to have structurally and cyclically lower unemployment than elsewhere in Europe. The consequence of that is that due to wage growth, you’ll probably continue to have a structurally higher level of inflation than you have in Western Europe.

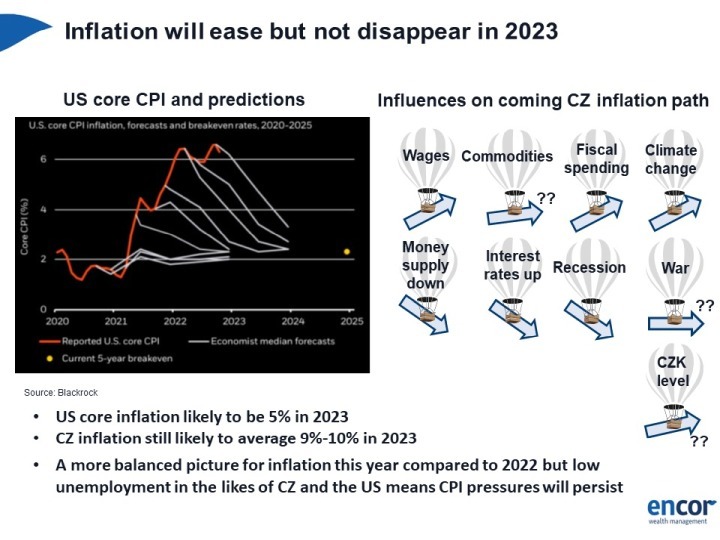

That’s also connected with higher growth…a silver lining for the cloud. The central bank has raised interest rates to curb inflation, but there are multiple influences on that.

When you raise interest rates, that’s anti-inflationary. When you have a recession, as we do in the Czech Republic, that’s also disinflationary. Slow economic growth helps drag inflation down. Then there’s the war. Ukraine and Russia are still at war, but we’re now 12 months on from that, so the shock effects from February/March 2022 is now baked into the inflation figures. We’re one year beyond that, so we’re no longer dealing with the shock effects.

Then there’s the currency. The deputy central bank governor stated clearly that the fact that the strong CZK has allowed them to leave rates where they are, rather than raising them further. Because in essence, the strong CZK is choking import price increases. Crude oil is cheaper in Czech koruna terms than if the CZK/USD was at 23. It’s now up to 21.5 per dollar. At the moment, we’re locked into a situation where there’s a premium for CZK interest rates relative to Europe and America, even though that premium is shrinking. In other words, as a speculator you can still borrow money in Euros or in dollars, put it in CZK and get a higher interest rate.

Does all of that tell you the Czech National Bank is right to risk recession by raising interest rates to 7%?

Does all of that tell you the Czech National Bank is right to risk recession by raising interest rates to 7%?

It tells me the economy is resilient. Technically, we’re in a recession, but it’s not a major downturn, it’s no disaster. It’s more of a needed pause in growth. Since the global financial crisis, everyone has feared the word recession. Everyone thinks that a recession is the same as the global financial crisis. It’s not. The global financial crisis was huge. A recession is just a contraction in which maybe 90% of the population isn’t seriously impacted, expect their wages don’t grow as fast, or they worry about their jobs. Unlike high inflation, which hits 100% of the population. What’s worse? And remember, inflation hurts the bottom half of the population harder.

Base euro interest rates have risen 250 bps to 3.75%. Doesn’t that mean that yields on prime properties in Western Europe have to go well above that? And that Prague yields can’t just nudge up by just 75 bps or 100 bps?

You would think so, because otherwise, you’re in a situation where investors aren’t getting much yield greater than the natural rate of inflation. That’s not a particularly attractive investment for an asset class that’s illiquid. The key thing about these large real estate assets is that they are mostly illiquid. It’s very difficult to securitize and break them up and sell them like a share. You have to factor that into the pricing. There has to be some kind of risk premium that’s added to the target return that justifies being invested in that asset.

The Czech National Bank has been hints recently that interest rates could actually begin falling in September. But then they say inflation would have to look like hitting single digits this year. And heading below five percent next year.

They are describing a scenario in which their inflation target in 18 months is 2%.

That doesn’t really seem feasible…it sounds more like central bankers trying to keep a market from panicking.

Correct. But they are basing their policy on what I’ve just said. Their current policy of 7% interest rates is based on the principle that in 18 to 24 months’ time, inflation will hit 2%. That’s their single mandate — to get inflation to 2% within that time frame.

With quantitative easing is being phased out, cash is being taken out of the system. What are you expecting the impact on property to be? Do you expect difficulties?

My analogy goes back to the bible — Joseph and Pharoah: 7 years of plenty and 7 years of famine. That’s my analogy. We’re in the 7 years of famine now.

Which year of the famine are we in?

Year 3. We’ve got several more years of this. You mentioned money supply. Money supply growth in the Czech Republic is negative, almost exactly the same as in the USA.

Why is that so significant?

Why is that so significant?

Money supply has been positive in America for the past 90 years. And it’s been generally positive in the Czech Republic since 1990. What we’re seeing now in my view is the need to take the excess money out of the financial system. My view on the 2008 crisis is that they made the wrong decisions: bailing out the banks, rather than restructuring them properly. This set the conditions for a massive boom in asset prices in equities, in credit, in private equity and in real estate. With zero percent interest rates you created conditions where people binged on the asset markets, creating the “everything bubble“. All asset classes went up in value substantially.

What’s happening now is that you’ve got this great reset in terms of the risk-free rate. Instead of 0% it’s 4%. There’s a pervading view that 0% rates were the new new normal, since we had them for the past 15 years — and that these last 2 years were an anomaly. I would argue the opposite.

And we’re now reverting back to normal.

We’re reverting back to normal because we have high inflation. The result is that you’re sucking liquidity out of the economy. It’s like squeezing a sponge. You’re squeezing the water out of the economy, but then you realize there’s still more. It takes time to get all of that excess liquidity out of the economy. We’re talking about years of excess money supply growth. Now, the banks are having to choose who they lend to.

At the same time, issuing bonds basically isn’t possible anymore for property companies.

It’s accessible but at a price. People are still coming to us with real estate development ideas, but the yields are well above 10%. That’s what they’re offering us. It’s just not something we’re interested in. Eventually, though, there will be a ‘biting point’. If they start offering, say, 13% interest, someone may decide that it’s worth the risk. But that’s a very high interest rate and it would mean their exit yield then has to adjust [upwards]. That’s the key. You can’t borrow at 13% and then sell at 7%. It’s nonsense. They’re going to have to recalibrate their business models.