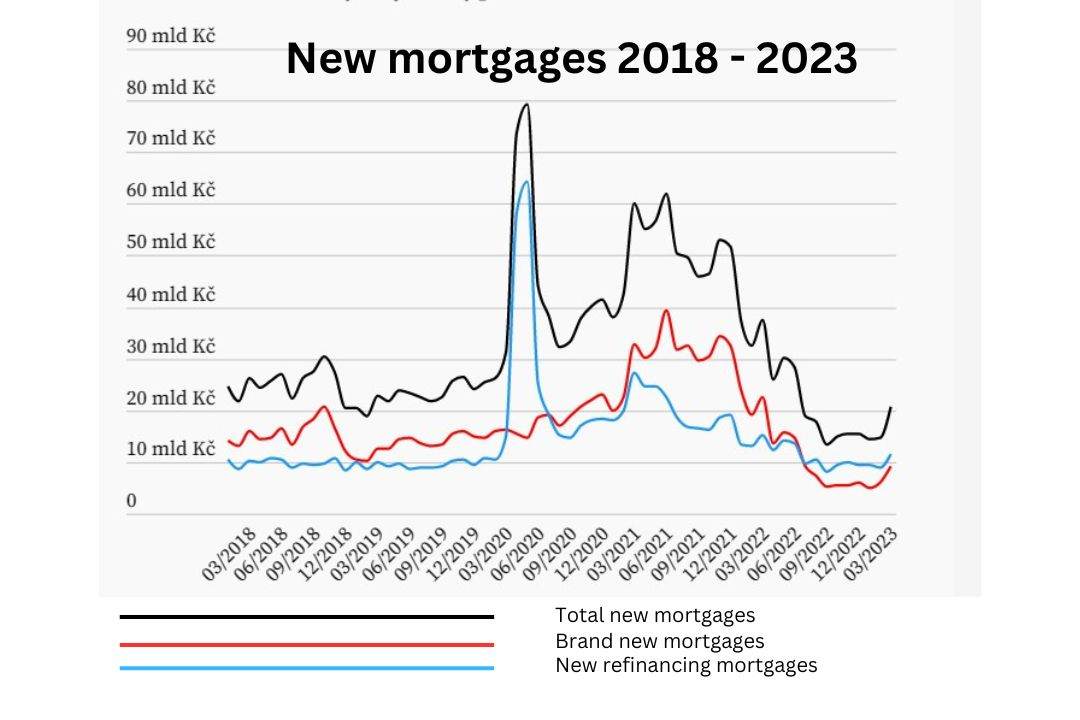

Central banks the world over are about to take their feet off the gas, when it comes to rate hikes. The Czech National Bank is way ahead of the curve on that account. The last time it raised rates was last July. That proved a body blow for the residential mortgage market, which was 66% down in April 2023 compared to April 2022. But the CNB is now considering loosening some key restrictions that have put mortgages out of reach for so many potential buyers. Along with LTV, the bank uses two key indicators to judge a borrower’s bonity. It sets a cap on the maximum percentage a monthly payment relative to the borrower’s monthly salary (DSTI). And it sets a maximum ratio of the total amount borrowed relative to the borrower’s annual salary (DTI). “The main problem is DSTI,” Libor Vojta of Broker Trust told E15. “In my view, loosening it in cases where the household has high wages would help, but it’s blocked.”

Of course, as a mortgage broker, it’s in his interest to say that. So, he’ll be pleased to learn (in the same E15 article) that the CNB thinks he may have a point. “Discussion about the possibility of adjusting the settings on credit indicators is relevant in a heightened interest rate environment,” said CNB vice governor Jan Frait in a recent seminar. The guardians of the Czech koruna loosened DSTI and DTI during the pandemic. If zero percent interest rates after March 2020 was a gas cannister, dropping DSTI/DTI levels was the spark which set off the final price explosion in the Czech residential sector.

By the time the DSTI restrictions were put back in place in April 2022, 15% of all borrowers were signing mortgages who monthly installments represented more than 50% of their monthly salary. That’s according to the Czech National Bank’s own statistics (as cited by E15).

“We recommended the restrictions be removed entirely on a temporary basis, but I don’t see that as very likely,” says Ostatek. “What’s more realistic is that the limits could be adjusted, because what’s really limiting is the narrow range of potential expections.” Banks are allowed to make exceptions to the DSTI restrictions for wealthy clients in a maximum of 5% of their mortgages.