Last year, more than 30,000 sqm of new office space came on line in Brno. So far, another 24,600 sqm has done so this year, but there’s only been 15,500 sqm of absorption to date. Which is why it’s only logical that vacancy is on the rise, according to Lukas Netolicky (Cushman & Wakefield). He’s been warning for months that while limited new development in the city has helped prop up occupation rates, a spate of new projects with few pre-leases will have an impact. This is pushing landlords to move carefully when it comes to rent indexation.

But the biggest problem facing developers of new office stock is the growing supply of newly vacated Class A premises. There’s been 42,000 sqm of gross take-up in H1 2023 (36% higher than a year ago) including a 21,800 sqm deal at Brno Business Park for Notino and Avast’s 6,100 sqm deal at Vlněna. But both of those pieces of business were renegotiations. The largest new deal C&W lists for 2023 in Brno is CGI IT’s 1,300 sqm lease at the Brno Technology Park.

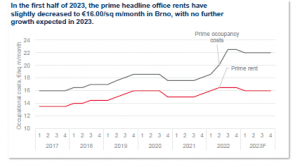

“Fully-equipped space available for sublease have been steadily increasing in Brno as some tenants downsize or relocate, creating an additional “shadow vacancy,” writes Netolický. “This space is becoming increasingly more attractive for office newcomers, as it is already fully fitted out and ready to move into.” One stat that helps explain what’s going on is the fact that compared to H1 2022, the vacancy rate in buildings that are more than 10 years increased by 11% in 2023. None of this is having a positive impact on prime rents, which have slipped slightly since last year to €16 (see graph below).

“Fully-equipped space available for sublease have been steadily increasing in Brno as some tenants downsize or relocate, creating an additional “shadow vacancy,” writes Netolický. “This space is becoming increasingly more attractive for office newcomers, as it is already fully fitted out and ready to move into.” One stat that helps explain what’s going on is the fact that compared to H1 2022, the vacancy rate in buildings that are more than 10 years increased by 11% in 2023. None of this is having a positive impact on prime rents, which have slipped slightly since last year to €16 (see graph below).

The fact is that the vast majority of demand in Brno is driven internally by the movements of corporations who are already present in the city, and by start-ups. Worryingly, this lack of new demand is reflected in a declining number of people of productive working age. Since 2011, the number of university students has fallen from 70,000 to barely 50,000. Regional cities across Europe are facing the same issues, but that shouldn’t stop local and national leaders from raising the alarm.

Also in ThePrime