Czech investors closed a dozen deals during Q3 2024, according to Savills. That’s the same number of deals as were completed in Q2, but the total transaction volume fell to €197 million — 63% down q-o-q and a 42% drop from Q2 2023. But the lack of any money from foreign buyers has thrown the abandoment by outside investors in the Czech market into sharp relief. Five of the deals totalling €67 million were in the retail sector, making clear the type of property changing hands. A pair of industrial properties also sold for €57 million while €51 million in residential investments were completed. More than half (58%) of the total investment volume occurred in Prague.

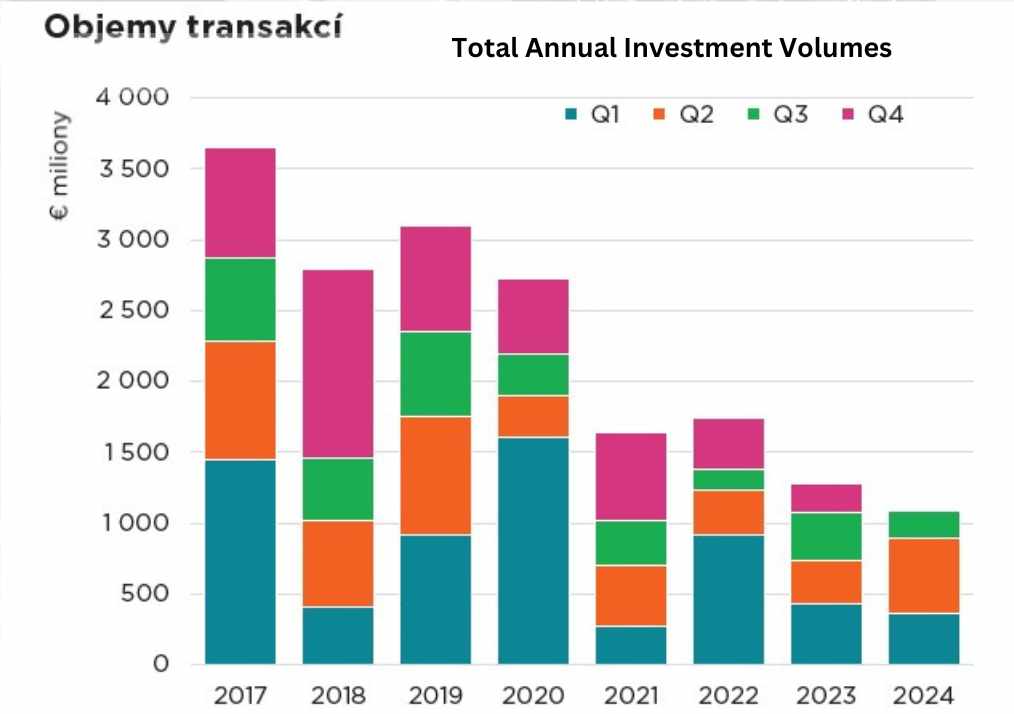

Savills hinted that the quiet of Q3 would be broken by a busy final three months, and that the year-end figures could show volume up by as much as 40%. The agency also sees this momentum carrying through into 2025 thanks to new product coming to the market, and a return to it by foreign buyers.

Earlier in the year, Savills’ Fraser Watson warned not to get too carried away by the dominance of Czech investors, saying it was partially due to the exodus of foreign investors. “Domestic investors had a dominant year in 2023 in terms of volume percentage, and everyone got very excited about how liquid the Czech market is, but in absolute terms, Czech investors spent 3.3% less their seven-year average. In 2018, domestic expenditure was €1.6 billion versus last year which was just over €1 billion, so last year wasn’t even the highest expenditure by domestic investors — by quite some way.