It would be nice to think that the outrageous increase in prices we’ve seen in recent months is just a flash in the pan. If you used to drive a little out of the way to pay CZK 2 or CZK 3 less per liter, the current price of CZK 48 is simply incomprehensible.

Mark Robinson (EnCor Wealth)

So, when April’s inflation rate fell from 8.5% to “just” 8.3%, headline writers jumped in to suggest that the worst might be over. Mark Robinson (EnCor Wealth) scoffs at them, saying their authors are “barking up the wrong tree.” He points out that in the United States, after a sharp spike in 1973, inflation settled into a sustained pattern of 5% per annum for the next ten years.

“The importance was not the initial spike but the sustaining of inflation rates well above Central Bank targets and an entrenching of inflation expectations in advanced economies,” he says. The same could be happening now.

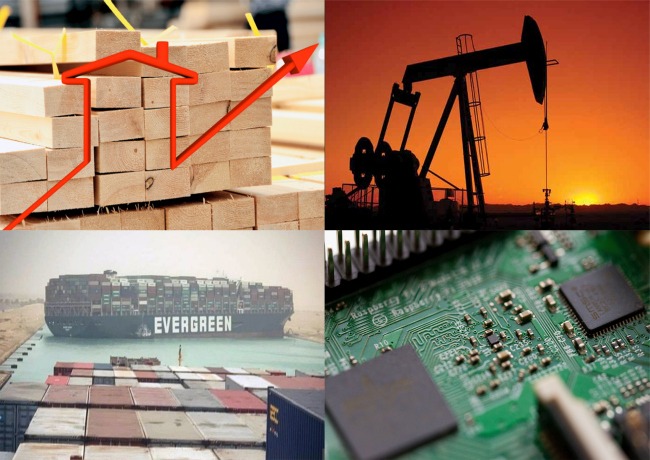

Robinson’s primary concern is whether inflation has even finished spiking yet, since oil prices continues to rise along with war-induced food commodity prices. “There are strong underlying currents which suggest that inflation will sustain at or above 3%, perhaps over 5% for some time.” These include continued low interest rates in the United States (currently just 0.75%), low unemployment (which means consumers continue buying) and private and government sector spending on ESG adoption and sustainable transport and power.

Robinson’s primary concern is whether inflation has even finished spiking yet, since oil prices continues to rise along with war-induced food commodity prices. “There are strong underlying currents which suggest that inflation will sustain at or above 3%, perhaps over 5% for some time.” These include continued low interest rates in the United States (currently just 0.75%), low unemployment (which means consumers continue buying) and private and government sector spending on ESG adoption and sustainable transport and power.

Michal Stupavsky (Conseq)

Michal Stupavsky (Conseq Investment Management) says the danger for Czechs as well as globally is that price pressures are largely structural in nature and that major central banks are still printing money as part of their QE programs. “I strongly believe that we are now slowly entering a new era of higher secular global inflation,” says Stupavsky.

“The CNB will have tremendous problems bringing the Czech inflation rate back to its 2% target during 2023. However, significant new rate hikes by the CNB might trigger a serious economic recession in the Czech Republic. This could call into question the stability of the Czech financial system, especially considering the precarious situation of Czech households in terms of mortgage loans. Personally, I would take a wait-and-see approach for now, keeping CNB’s rates on hold while utilizing the FX reserves further in case of additional pressure on koruna. On top of that, in my opinion there might also be a discussion about potentially raising the CNB’s 2% inflation target.”

Also in ThePrime

Jiří Snížek: Coordinating growth in two-speed Central Bohemia

ČNB’s interest rate hikes no match for real estate inflation