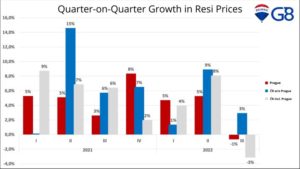

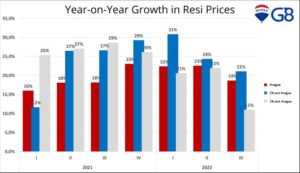

If reservation contracts for the third quarter of 2022 are any guide, Czech resi prices could stop rising in the Czech Republic. Even in Prague. That’s the shocking prediction Iztok Toplak has made based on the data of the company he works for (RE/MAX G8 Reality). In his most recent newsletter, he wrote that “Reservation orders for the third quarter of this year suggest that we can expect a halt to the rise of prices across the whole Czech Republic and a slight decline in Prague compared with the second quarter of the year.” He claims tracking reservation prices has strong predictive value. What they lack in accuracy compared to deals listed in the land registry, they make up for in prescience.

Drilling down into the data, he says flats in “brick” buildings continued rising through the end of the second quarter in Prague, reaching an average of CZK 130,000 per sqm. Panel buildings, however, peaked at the beginning of the year and have been falling slightly. He puts the current average price at CZK 109,000 sqm. The average price outside Prague is so low (CZK 60,000/sqm) that they’re still rising, driven, he claims, by the scramble to buy anything that’s affordable. While quarter-on-quarter prices may be slowing though, he says the year-on-year numbers will show an 11% increase countrywide and a jump of 19% in Prague.

Why the slowdown?

“Interest rates,” Toplak told me over the phone. He says the situation for buy-to-rent individuals has turned around. For the worse. “Last year, the rent was CZK 16,000 and and the payment was CZK 15,000 if you put down 20% as a deposit. Now you need to put down 20%, but you pay CZK 28,000 and the rent is only CZK 20,000. From an investment perspective, that’s a big difference.” Looked at a different way, back when mortgages were on offer at 2%, investors were getting roughly a 3% return. To achieve that today, he says, rents would have to increase far more than is feasible. “Now they won’t get a loan, it’s too expensive. So, they don’t buy.”

Low interest rates were a huge driver of prices, but they weren’t the only reason. For starters, the country’s population has risen by around 600,000 over the past 20 years. Combined with that, economic growth has seen Czechs grow wealthier, leading to a desire to live in larger homes and a tendency to own second flats that aren’t permanently occupied. Residential supply hasn’t kept up with these trends, especially in the country’s larger towns.

Also on ThePrime

Marco Maio: On tornados, renewal and architecture (Podcast episode)