You’ve had a lot of apartments to sell at one of the few tricky times the Prague residential market has ever seen. You must be happy to see better times around the corner.

We put a lot of product on the market last year. In a market with very difficult sales and difficult funding we found some relief in better construction costs. And we’re pleased that we now have a substantial volume of residential product for sale and we see that market ticking up. But I think the biggest thing we did with residential last year was to bring it into our ESG strategy. Crestyl formally launched its ESG strategy last year and we’ve included all of our residential projects in it. ESG has always been driven by the commercial market with the need for environmental certificates for institutional product. All our new residential projects will be BREEAM certified, starting with building Kappa in Hagibor project.

Post-energy crisis, Czechs may appreciate the advantages of lower running costs at home. But is ESG really a driver for the residential sector?

There is no upside for ESG strategy with Czech residential customers to date. Green branding, large public areas and low energy costs are exciting for Czech customers, but BREEAM or LEED certification isn’t their focus. Nevertheless, as a group that’s achieved a certain size, having a fixed ESG strategy which spreads beyond the commercial portfolio is absolutely critical for Crestyl. As we look to fund the group to expand into Poland and beyond, having an ESG strategy is critical.

You have an investment arm for your own product. Is that where all the commercial buildings you’ve been developing go, at least until you’re ready to sell?

We build and then transfer our commercial assets as an income stream into our portfolio. That’s the business plan we made even before the downturn. We stabilize the income of the assets, improving the portfolio’s value. For example, our exit with Central Kladno four years ago happened after the income had stabilized and we’d increased the value of the asset.

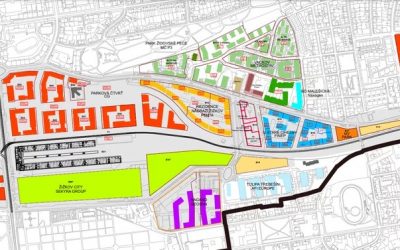

Everything you see here at Docks is in our investment arm. The first phase of Hagibor was a JV with EPH. But future phases of Hagibor will all go into our investment portfolio too. In 5 years, they’ll be fully leased and operational. With our community management it will maintain the highest levels of tenant retention, with companies remaining rather than re-leasing. That’s how we create value. In the meantime, having a fixed rental income is very healthy for the group, especially during difficult times.

Rates have fallen a bit, so the mortgage scene is waking up. That’s sparked some demand, even though mortgages aren’t cheap yet. What’s your sales outlook?

Demand is picking up. Our sales are starting to perform according to our expected business plans at the beginning of the year, which was slower than expected. It was a difficult beginning to the year. Today, I sense a lot of international pressure for a reduction in interest rates. Look what’s happening in the US, where the FED is under substantial pressure to reduce interest rates. Look at the European economies. Germany is touching recession again, that’s going to put pressure on the ECB to reduce rates. Demand in the Czech Republic remains the same. Affordability is too high but salaries are increasing as well, which gives people hope. People want apartments, they need apartments. Supply is low because of the permitting, so people will continue to buy. There’s a belief that interest rates will drop and that’s now generating sales.

In Brno, the demolition of Tesco is cleared to go ahead, so you can finally make progress on Dornych. Is it a tricky one to plan for? There’s a lot of foot traffic going through Vaňkovka but i.’s also potential competition?

Vaňkovka is a great project. In our discussions with ECE, we’ve always presented it this way. We’re taking your Vankovka and giving it a competitive edge because together we become a real destination. We connect Vaňkovka with the city center. It’s truly a wonderful concept we’re delivering, connected to the downtown and the train station. Plus you’ve got the critical mass to make it super-regional as well. I see us as a retail force connecting the downtown and Vaňkovka. And tenants are responding to that. There aren’t a lot of premium products on the Brno market. We’re comfortable that it will commercially be viable from the beginning.

It does create more competition in the middle of town for existing retail, as if there weren’t enough from the larger ones along the edges. Has there been any complaints about that?

The city has been a great supporter of the development of our project and the whole south zone following the decision for the new train station. You need to forget about how Prague works in the center. When you go to Brno, you see it’s full of people that live and work in the city. They actually enjoy their city center, and they have great public spaces. Being part of that is what you want to do. I don’t see that Vaňkovka is taking people away from the center. I think adding us it will make it more of a destination itself.

Also in ThePrime

Reico waves ‘goodbye’ to Čtyři Dvory, ‘hello’ to rental resi