Near the end of June, Czech National Bank governor Jiří Rusnok will be running his last-ever meeting of the country’s bank council at which interest rate decisions are made. And the outgoing CNB boss has let it be known that we can expect yet another interest rate hike. “Without raising rates it’s simply not possible to bring inflation to appropriate levels,” he said. “That’s an illusion.” On its face, that sounds like a simple statement of economic law.

“But” while the CNB is supposed to be politically neutral, it’s interesting to note that the interview his remarks are quoted from in Aktualne.cz are on the front page today of the Czech National Bank’s web page. So, Rusnok may be sending a message to his replacement, Aleš Michl. Two quick facts about Michl: 1) He’s an opponent of further rate hikes who was nominated by outgoing Czech president Miloš Zeman 2) He’s seen as an ally of the assumed candidate for next president, Andrej Babiš.

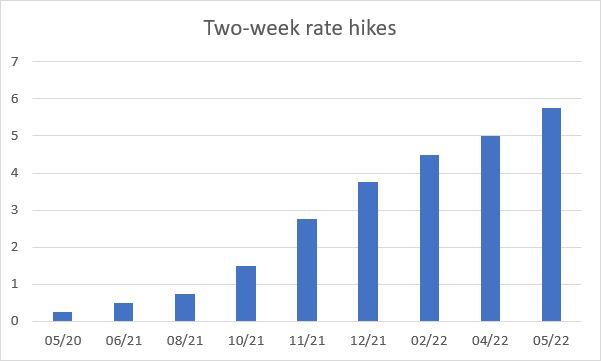

Asked if it’s true that the bank could raise interest rates (already at 5.75%) by another 75 bps, Rusnok did nothing to calm such fears. Asked if it’s true that the bank could raise interest rates (already at 5.75%) by another 75 bps, Rusnok did nothing to calm such fears. “What we know for the moment is that we have a weaker koruna than our model was counting on. So, we can’t limit ourselves with some ceiling. So, yes, for the moment it looks like three-quarters of a percent or more.”

Rusnok also swatted aside future CNB governor Aleš Michl remark that further rate hikes are pointless because the current inflation spike is “imported.” “No one has invented anything that’s better than what we’re doing,” he said. “If I had a better alternative under the rules, I wouldn’t mind a debate about it. But there is no such thing.”

So, interest rates should 6.5% by summer. That would mark a 6% hike in rates in just over a year. If that isn’t a head-on collision for mortgage-based demand for residential, what is? A lot of other things should be in play now, though. Consider: on the one hand, rates haven’t been this high in decades. On the other, an anti-rate hikes governor is about to take charge of the Czech National Bank. That smells a lot like like bond buying season.

Writing in Hospodářské noviny, Jan Chlumský (Amunid CR Asset Management) notes that Czech 10-year treasuries have fallen more than 20% in price over the past 12 months. “The million koruna question is whether the worst is over for Czech state bonds and if the time is ripe for buying them, for example through bond funds. For that scenario to work, we need above all stability and for a fall in domestic interest rates to be within view…We don’t know the ideal moment to start buying them, but the noise from the investment community suggests that not much time remains until the countdown to the start of ‘the new bond era’.

Also in ThePrime

Robinson & Stupavsky: Forget the headlines…Inflation hasn’t given up just yet