Inflation in the Czech Republic dropped to single-digit levels for the first time in June since January 2022. As of May, upwards pressure on price had only fallen to 11.1%, according to the Czech Statistics Office but last month’s number came in at “just” 9.7%. The question is where does inflation go from here? And will the Czech National Bank react with lower interest rates? For what it’s worth, the answer to the first question almost certainly “down”, while the answer to the second is probably “yes”.

Ceska sporitelna’s analysts are predicting for example that inflation will fall still further to 8.6% in July and to 8.2% in August. Other local banks are essentially predicting a variation on that theme. Most analysts are also expecting the CNB to reduce interest rates at some point this year.

But there’s a big difference between 8% inflation and the accepted 2% that most central banks aim for. And that’s what should be worrying companies, investors and funds whose business model is based on the ultra-low interest rates we all got used to in the last decade. Because just as central bankers were under pressure to leave rates alone as we slipped into this inflation crisis, they will be reluctant to cut them as we ease our way out of it.

Consider recent quotes from the top tiers of the ECB. Its Governing Council member Francois Villeroy de Galhau warned readers of Bloomberg not to get too excited, just because European inflation appears to have peaked. “In the euro area, I believe we will soon reach the high point of interest rates,” he said. “But when I say high point this isn’t a peak, rather it will be a high plateau, on which we will have to remain for a sufficiently long time to fully transmit all the effects of monetary policy.” In fact, if you read that quote carefully, he’s basically confirming that rates will go up (probably on July 27) before they come down.

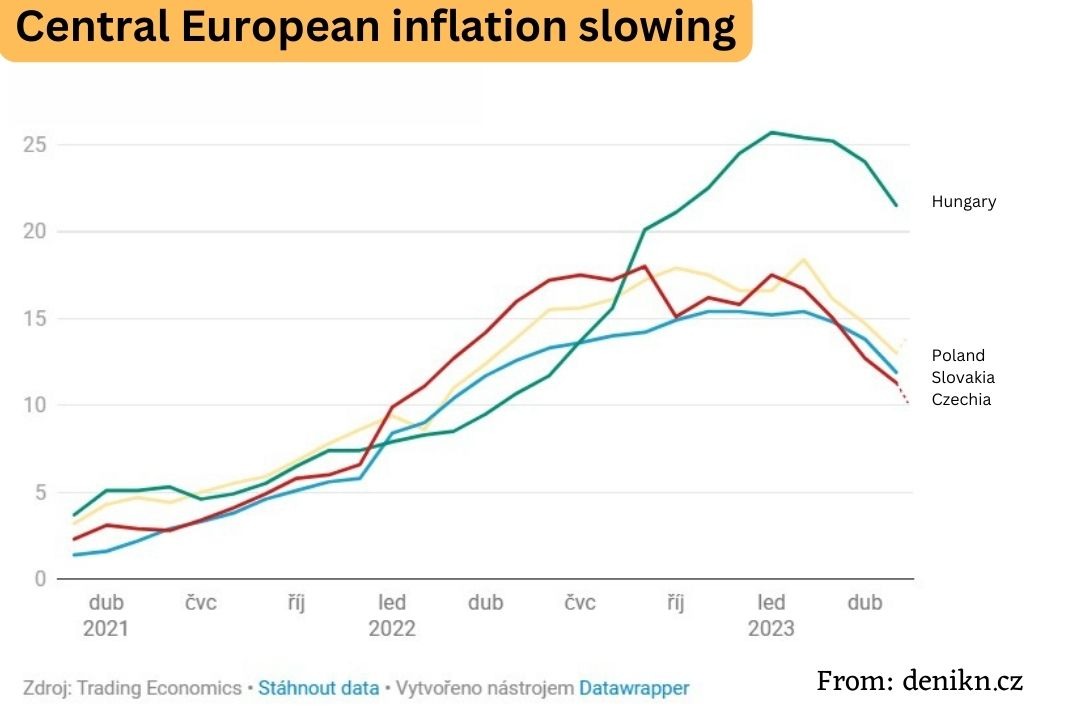

The Czech situation is far from ideal, but with interest rates of 7% it’s doing better than anywhere else in the non-euro portion of Central Europe. Hungary’s currently suffering from inflation of more than 20%. Things are so bad there that a recent reduction of a key interest rate to 17% is classified as good news. In Poland, inflation has fallen to 13% from its February high of 18%.

“The process of disinflation is in full swing in Central Europe,” said Nicholas Farr of Capital Economics. “In the coming months, inflation in the entire region should continue falling and we believe that it will be single digit in all the countries by the end of 2023.”

“However, it will take a long time before inflation falls to the goals of the central banks. Central banks will therefore be very careful over the next six to 12 months when reducing rates.”

Also in ThePrime