Can housing be affordable? That was the name of the workshop put on by Wolf Theiss and ThePrime at Sal architektů. Given the multiple causes of over-priced real estate here, the simplest answer is probably ‘not for now’.

And yet, there are signs of hope that new initiatives could help at least mitigate the constant grind of rising prices. The most promising of these was the prospect of deploying ‘long money’ from Czech financial institutions into the development process. Pavel Kelner of Dostupne Bydleni, a subsidiary of Česká spořitelna. He said that investors whose return-on-investment timelines are measured in decades can underwrite rental projects that target essential professions such as healthcare workers.

Cities can also do more along these lines. Petr Urbánek, director of the Prague Development Company, said his company’s lack of a profit motive allows it to produce more affordable projects. PDS’s mission is essentially to prepare land owned by the city into development projects. Once completed, they will be leased at more affordable rates to essential workers and disadvantaged people. But as Urbanek told the workshop’s co-moderator Tomáš Kren (Wolf Theiss), not even PDS can speed up the approval process. So, while it has projects with more than 8,000 flats in planning, there are no quick fixes for today’s problems.

One of the workshop’s successes was bringing together public and private sector speakers. Prague’s deputy mayor Petr Hlaváček (Head of City Development) voiced his determination to keep Prague as a city for everyone and not just the rich. “From my point of view, Prague’s diversity is the one positive part of our communist history. I felt that in my childhood and I feel that still…that you get people from the working class living on the same street as university professors and secret agents. It has a certain beauty. And I’m doing everything to keep that because I think it’s wonderful.”

Everything, it should be said, does not include rent control, thanks to the trouble it caused back in the 1990’s. Hlaváček admitted that the city of Vienna serves as an example of how rent control can help promote a mix of residents. But he said it’s a system that city has been perfecting the method for over 100 years.

In fact, Vienna’s rent control system is so successful, it’s created an international relations department to promote the idea. Its directors took part in the Affordability Workshop, providing one of the most interesting portions of the event. One of the primary reasons rent control works in the city said Veronika Iwanowski is that so many people benefit from it: 50% of the Viennese live in such flats at the moment.

“We have 220,000 municipal homes which are managed by our company and belong to the city of Vienna,” said Iwanowski. “In addition, there are 200,000 subsidized homes. So, in total 420,000 affordable homes.” The system is funded by a 0.5% tax on employee wages that results in annual revenues of €250 million for use in housing construction. The city invests another €200 million per year into housing via loans it hands out to developers of rent-controlled units. “We believe it’s better to proactively invest in the creation of affordable homes than to reactively treat this symptom of social inequality,” she said.

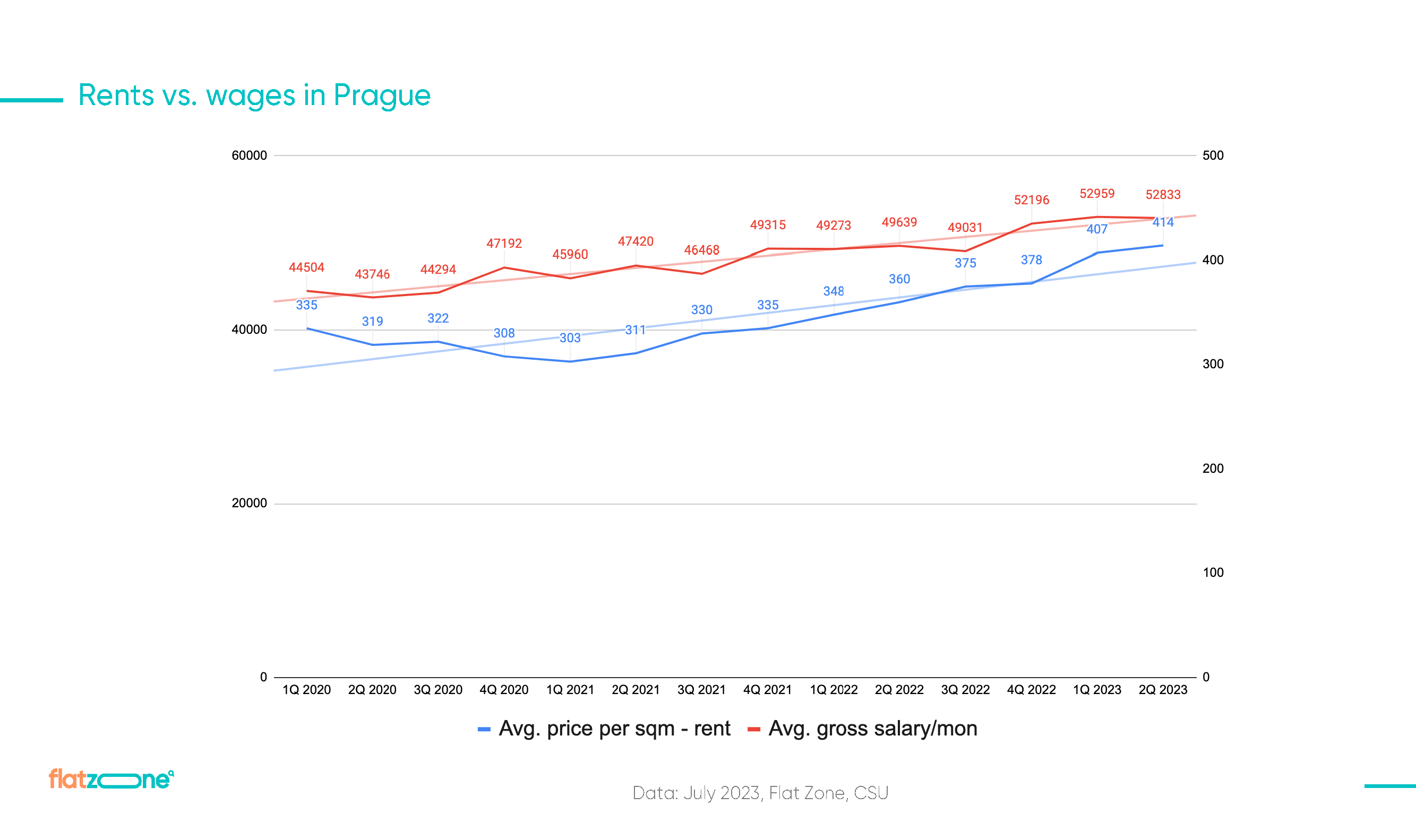

If rental housing in Prague isn’t likely to be more affordable in the near-term, could it become less affordable? So far, at least, the evidence doesn’t support that. Vit Soural (Flat Zone) says the research his company produces produced surprising results. “What we’re seeing is that the rents and wage ratio has only worsened a little. I was surprised by the results because I expected that rents would be growing far more than wages.”

What residential investors will find encouraging is the fact that flats in BTR projects command 25% higher rents than those leased by individuals. “The market average for BTR project is about CZK 550 per sqm, while for the standard segment it’s only about CZK 420,” said Soural. Depending on the services, location and furniture in the units, rents can be raised accordingly.

While investors aren’t predicting sharp rises in the near future, the sector continues to look encouraging. “What we could see in the past years is that the capital values more than doubled in the past ten years, and we see that rents always follow, though with some delay,” said Erik Janovsky (Mint Investments). “As a build-to-rent investor, we’re satisfied that rents are rising, but we feel that in the next couple of years the rents won’t jump. They’ll probably correlate with nominal wages, so that affordability stays the same.”

Other speakers at the event included Christian Schantl (Wiener Wohnen), Tomáš Kadeřábek (Assoc. of Developers), David Mazáček (Crestyl), Peter Oberlechner (Wolf Theiss) and Jindřich Fialka (Q Designers) and Radek Kučera (Halcyon).

Also in ThePrime