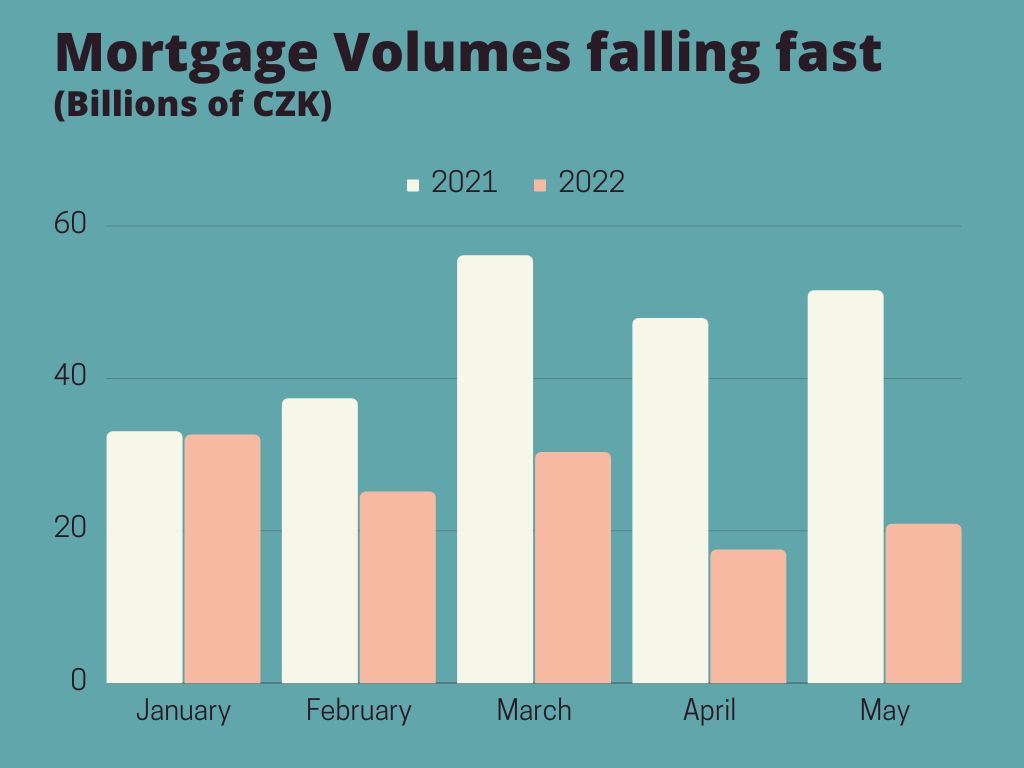

The Czech mortgage market is in freefall. A year ago, with loan rates around 2% and residential values continue to leap in value, it seemed foolish not to buy a flat. With mortgages now coming in at over 6% and prices beginning to slip (at least in Prague), common sense dictates otherwise. Hospodářské noviny spoke with the mortgage analyst Jiří Sýkora (Fincentrum & Swiss Life Select), who said things are getting critical for people with standard wages. “If you have a not very luxurious flat for CZK 8 million in a big city and rates of 6%, then you’re talking about monthly payments that not even the middle class can afford.” Even if a family could put down CZK 2 million as a deposit, he says, they’d have to pay more than CZK 40,000 each month. As a result, mortgage volumes have fallen 60% in the last year. Armies of mortgage agents have deserted and are going over to life insurance. “Some banks are at around 20 to 30% of last year’s volumes,” says Jiří Vagner (Next finanční). And there’s every expectation that the second half of the year will be considerably worse than the first.

The online furniture retailer Donashop declared insolvency last week after 25 years on the market. It’s a sign that consolidation on the e-commerce sector is on the way, following a couple of incredible years fueled by the pandemic. HN reports that Donashop had generally done well throughout its history, with a minor blip during the financial crisis. But the pandemic helped its monthly revenues soar to more than CZK 14 million. Then the market fell away at the beginning of 2022 at the same time as expenses began rising in earnest. In its insolvency filing, it wrote that unprecedented inflation had forced consumers to cut down radically on all but the most basic expenses. “I expect many smaller e-commerce companies will end their activities, either voluntarily or they’ll be forced to by insolvency when creditors intervene in the case of larger debts,” Patria Corporate Finance’s Milan Bilek told HN. He says the big e-shops will slow down for the market’s speed bumps, but will ultimately drive away with even more customers than before.

The online furniture retailer Donashop declared insolvency last week after 25 years on the market. It’s a sign that consolidation on the e-commerce sector is on the way, following a couple of incredible years fueled by the pandemic. HN reports that Donashop had generally done well throughout its history, with a minor blip during the financial crisis. But the pandemic helped its monthly revenues soar to more than CZK 14 million. Then the market fell away at the beginning of 2022 at the same time as expenses began rising in earnest. In its insolvency filing, it wrote that unprecedented inflation had forced consumers to cut down radically on all but the most basic expenses. “I expect many smaller e-commerce companies will end their activities, either voluntarily or they’ll be forced to by insolvency when creditors intervene in the case of larger debts,” Patria Corporate Finance’s Milan Bilek told HN. He says the big e-shops will slow down for the market’s speed bumps, but will ultimately drive away with even more customers than before.

June consumer price inflation pushed on from May’s horror show to hit 17.2% y-o-y. Drilling down, prices on goods jumped 19.3%, while services lagged behind at 13.9%. Commenting on the terrifying numbers, ING’s Frantisek Taborsky writes that it expects things to get worse thanks to increased energy prices, which will impact July and August figures. “Our current nowcast shows inflation rising further to 17.8% in July, however, given the above we could see a much bigger jump and we could see inflation very close to 20% YoY over the next three months.” He predicted that the Czech National Bank would most likely leave interest rates where they are in August, but that this would inevitably lead to renewed pressure on the koruna.

Also in ThePrime

Iztok Toplak: Czech resi prices have peaked, including Prague