Which three economic indicators or trends will have the biggest impact on the investment market?

The three economic indicators I think can have the biggest impact are inflation, interest rates and the story around GDP across the wider European sphere. I note that Germany is already in a mild technical recession. I don’t know if here in Czechia we’ve technically hit 2 quarters in a row during 2023, but year-end landed at-.4% GDP, taking the full year into negative territory. This stream of mildly bad news can just dent overall confidence, which ultimately drives a lot of investment decisions.

If you see a country is performing strongly, there’s a feeling of confidence in the business environment. There’s going to be occupational demand, companies will be expanding, there won’t be as large of a threat of bankruptcies, and you’ll get inflows of, and demand for, labor, helping to drive consumer demand in turn. Ultimately, a property landlord wants to understand that there’s a market for their space to be leased to a tenant that can pay the rent for the remainder of the lease. And that they’ll have the money to take care of the things in the property that they should do. It’s as much about confidence as anything else.

If you believe investors will be busier this year than in 2023, what was holding them back last year? And why will this year be different?

That’s the interesting part of your question. Yes, I think it will be busier this year. From an anecdotal point of view, this is just about the busiest I’ve personally been at Savills since I started in 2018. That’s crazy when I compare it to my expectations coming back in January after the holidays when there was a feeling that the year was going to start much slower. Suddenly, though, it really ramped up. We’re really noting a lot more owners coming forward willing to put their hands up to say “we’re a seller” not fearing they’ll get their hand bitten off by a bunch of sharks who smell blood.

What happened?

There’s more confidence that interest rate rises have stopped, which means there’s a little bit more certainty. There have been more transactions in the market that have happened that give a feeling about where the price floor is. You don’t have to worry as much about being the one to catch the proverbial falling knife. There’s a level of confidence in the market that prices now are probably about where they’re going to settle. I think FOMO (the fear of missing out) in 2024 is possibly going to creep back into the market — probably in the 2nd and 3rd quarters — as investors see there’s a greater level activity being done by other investors which will push them back into the market.

Back to my question: What was holding back investors last year?

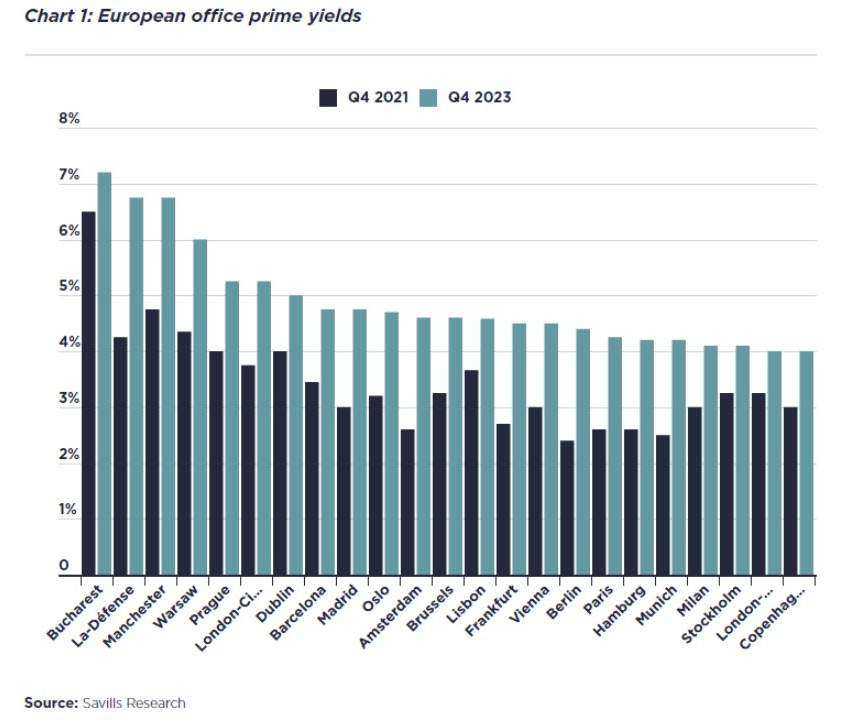

The uncertainty. What’s going to happen with inflation? What’s going to happen with interest rates? Is anyone else buying? Do we need to be the first mover? For the Czech funds, many have been just keeping a large portion of their money in the bank and taking a healthy 6% to 6.5% on their money with very little risk taken. What I understand from the funds who are doing that is that the general message from their investors is they’re not getting supreme pressure to deploy the capital into real estate just yet. They’re making the returns they said they would with just cash in the bank.

Are looming loan defaults or refinancing difficulties driving owners to become sellers?

Are looming loan defaults or refinancing difficulties driving owners to become sellers?

The short answer is no. If I think about all the deals we’re working on, there isn’t a single case where a refinancing event is driving the sale. There have of course been examples of financing-led decisions making the process happen but no situation I am aware of where a debt term event forced a sale. There have been multiple examples of potential sellers either opting just to refinance and continue to hold, or to pay off the debt at Term end out of equity in order to avoid the need to go to market with a perception of being a seller in need of selling.

It’s interesting, because it wasn’t so long ago that most people were expecting finance-related distress to be a major issue.

In 2022, a lot of agents were getting ready for a surge of product coming to market with somewhat distressed sellers. But in general, the banks are reluctant to take back the keys and are working well with owners to reach mutually acceptable solutions to debt Term events. And in general, if you’ve owned the building for, say, five years and you’re coming to the end of your hold period, then you bought it in 2018/19 when yields were c.150 basis points softer than they are now. Even on a valuation basis, and tracking the same LTV, you probably don’t have to put in much cash for the bank to feel stable. You’re not underwater. The banks have been lending at 65% for many years now, so you’re in for 35% equity. It’s not a situation where equity has been wiped out of real estate because the equity ticket was so big at acquisition that the bank’s protected. Property values haven’t shifted by hundreds of bps, only 100 to 150 bps, which isn’t generally enough to push owners into negative equity territory.

The Czech market is odd that way, isn’t it?

A sensible and cautious approach by banks since GFC, of course governed in large part by the subsequent banking rules that came in, has contributed to a less severe impact on real estate values during this period of economic turbulence. In Czechia, values are holding up pretty well and investment activity remains pretty active – just 29% down y/y in 2023, as compared to e.g. Germany at .c 60% and Poland at c. -66%. When I tell our cross-border guys in the UK that there are deals for industrial in Czech under offer at yields “starting with a 5” for industrial, they’re still quite surprised that prices have held up so well.

Maybe because they’re used to riskier markets, with bigger swings in value.

That’s why Czech investors are so relevant. Because the internationals can’t and won’t compete at the prices that the market is still maintaining.